News

Trump Media falls 18% after filing plans to issue more DJT stock

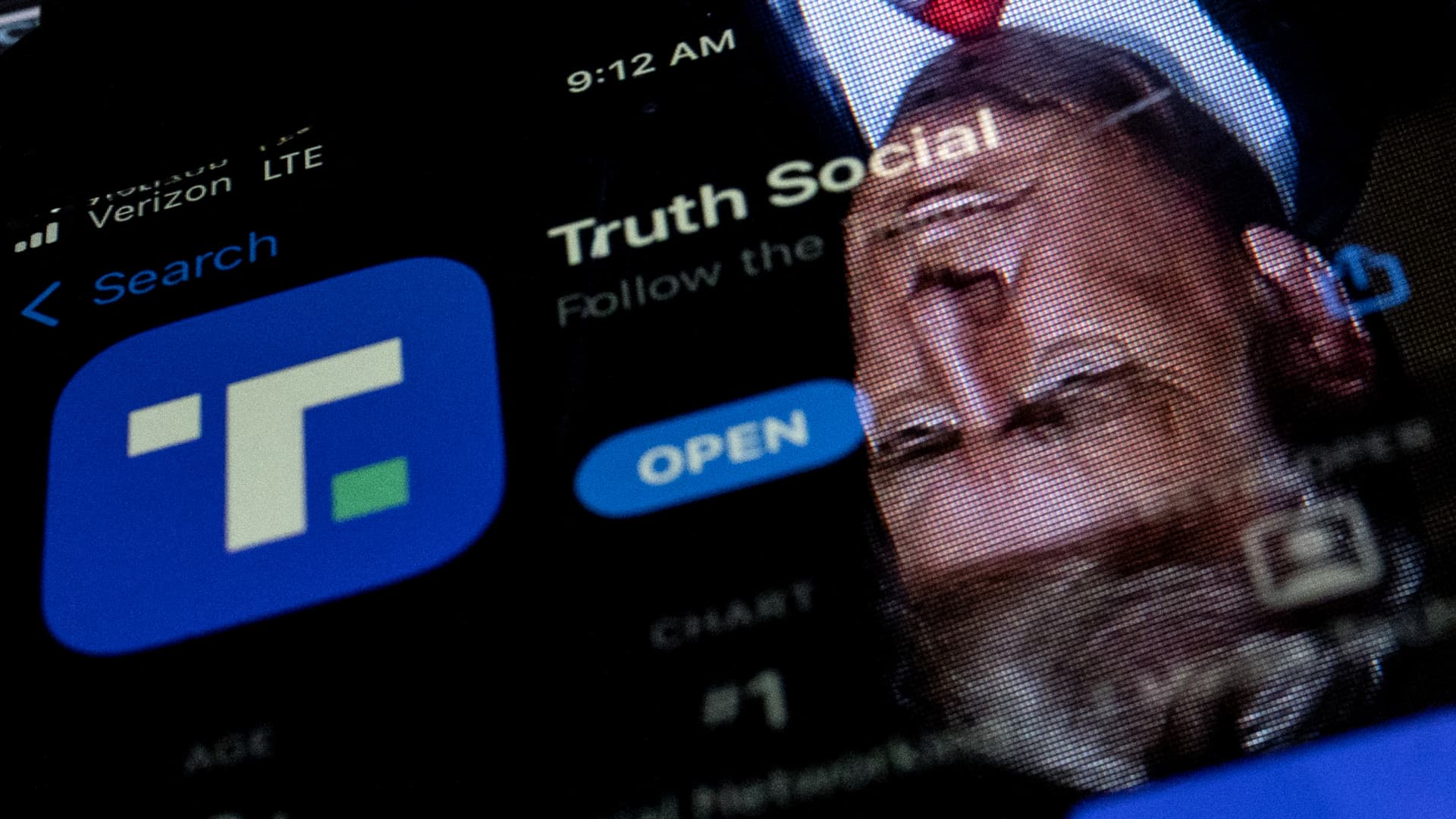

This picture illustration exhibits a picture of former President Donald Trump mirrored in a cellphone display screen that’s displaying the Reality Social app, in Washington, DC, on February 21, 2022.

Stefani Reynolds | AFP | Getty Photographs

The share worth of Trump Media closed buying and selling down greater than 18% on Monday after the corporate disclosed plans that will enable current traders to train inventory warrants.

DJT shares closed at $26.61. Trump Media, which created the Reality Social app and trades on the Nasdaq, fell practically 20% final week.

The corporate’s dramatic slide got here as Donald Trump sat in a Manhattan courtroom for the beginning of his legal trial on hush money-related expenses. Trump is almost all stakeholder within the firm.

Because it started public buying and selling on March 26, Trump Media’s share worth has fallen greater than 62%, from a gap worth of $70.90 that day all the way down to round $27 on Monday.

Because of this, its market capitalization has been slashed by practically $6 billion, leaving it at round $3.7 billion as of Monday.

The corporate’s intent to concern extra widespread inventory was disclosed in a preliminary prospectus filed with the Securities and Alternate Fee.

The shares can’t be issued till a registration assertion with the SEC takes impact.

The submitting describes a plan to supply greater than 21.4 million shares of widespread inventory, issuable “upon the train of warrants,” the submitting exhibits. Inventory warrants give their holder the flexibility to purchase shares at a predetermined worth inside a sure time-frame.

Trump Media predicted within the submitting that it’ll obtain “as much as an combination of roughly $247.1 million from the train of the Warrants.”

The closing worth of Trump Media’s warrants was $13.69 as of Friday, in line with the submitting. The warrants are being traded on the Nasdaq underneath the ticker “DJTWW.” That ticker fell greater than 15% on Monday.

The corporate additionally seeks to supply the resale of as much as 146.1 million shares of inventory from “promoting securityholders,” 114.8 million of that are held by Trump himself. Trump owns 78.8 million shares of the corporate, and stands to acquire 36 million “earnout shares” if the inventory stays above $17.50 for sufficient buying and selling days.

Trump’s present stake within the firm — practically 60% of its shares — was price greater than $2.2 billion at Monday morning’s share worth. Trump shouldn’t be allowed to promote his shares till a six-month lockup interval expires.

The lockup interval is a situation of Trump Media’s long-delayed merger with the shell firm Digital World Acquisition Corp., which was finalized March 25.

Trump, whose social media following was massively diminished after he switched to Reality Social following his suspension from Twitter and Fb in 2021, has tried to encourage his followers to flock to the fledgling app. It’s unclear if they’ve heeded Trump’s name: The corporate has not publicly launched key efficiency indicators, together with the variety of lively Reality Social customers.

It has, nevertheless, revealed a web lack of $58.2 million on income of simply $4.1 million in 2023.

“The inventory valuation is indifferent from the fact of the financials,” stated Ben Silverman, head of Verity Analysis.

But when the inventory worth holds excessive sufficient for the corporate to concern earnout shares, Trump and different insiders might be in line to obtain a windfall price greater than $1 billion at present buying and selling costs.

-

News4 weeks ago

News4 weeks agoMichael Douglas jokes he and Catherine Zeta-Jones ‘seduce’ their kids with vacations

-

News4 weeks ago

Did Kate Martin get drafted? What to know about WNBA Las Vegas Aces guard

-

News4 weeks ago

News4 weeks agoKesha Switches “Tik Tok” Lyric About Sean “Diddy” Combs at Coachella

-

News4 weeks ago

News4 weeks agoMichael Douglas Jokes He and Catherine Zeta-Jones ‘Seduce’ Kids with Trips

-

News4 weeks ago

Sydney church stabbing: Attack on Bishop Mar Mari Emmanuel a ‘terrorist act,’ police say

-

News4 weeks ago

News4 weeks agoKesha slams Diddy in tweaked ‘Tik Tok’ lyrics at Coachella

-

News4 weeks ago

News4 weeks agoKate Martin attends WNBA draft to support Clark, gets drafted

-

News4 weeks ago

News4 weeks agoGossip TikToker Kyle Marisa Roth Dead at 36