News

Snap’s Stock Surge Is Latest Example of Earnings Volatility

(Bloomberg) — Snap Inc.’s sizable post-earnings swing Friday is nothing new to its buyers. What’s completely different this time is the course: up.

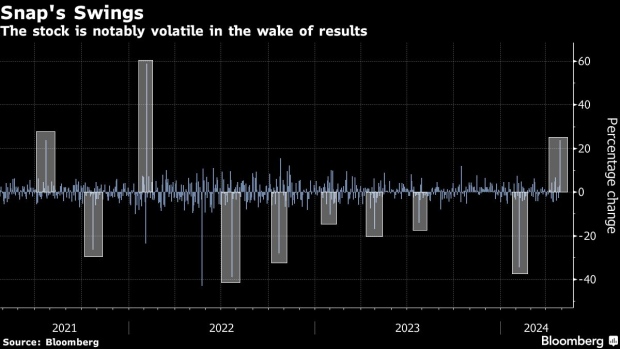

Shares of the Snapchat father or mother gained as a lot as 30%, the newest instance of the social-media firm’s historical past of giant strikes on quarterly experiences. Because the second quarter of 2021, ten of the final 12 experiences have been met with double-digit swings, with the strikes starting from a selloff of virtually 40% to a achieve of practically 60%.

The typical worth transfer in response to the corporate’s earnings has been a swing of 19.8%, in keeping with information compiled by Bloomberg. Amongst its ten nearest rivals within the Web media & companies business, Roku Inc. is the one one that’s equally risky, averaging a 16% transfer. The typical for the group is roughly half of Snap, at 10%.

Friday’s rally got here after Snap gave a powerful gross sales forecast, easing issues about its prospects and spurring not less than one analyst improve. That is the primary time the inventory has seen a constructive share-price response to outcomes since April 2022.

The outcomes have in any other case served as unfavourable catalysts. Previous to the latest report, Snap’s previous seven experiences triggered selloffs. In February, shares ended down about 35% after the fourth-quarter outcomes underlined progress issues. Even with Friday’s achieve, the inventory stays down about 15% this 12 months, in contrast with a achieve of 24% for business chief Meta Platforms Inc.

Whereas a lot of the inventory’s greatest strikes over the previous few years have been on earnings days, its greatest one-day drop occurred in Might 2022, when it lower its forecast.

–With help from Tom Contiliano.

©2024 Bloomberg L.P.

-

News4 weeks ago

News4 weeks agoHurricane Beryl maps show path and landfall forecast

-

News4 weeks ago

News4 weeks agoIs Simone Biles married? What to know about the Olympic medalist

-

News3 weeks ago

News3 weeks agoPortugal vs. France, picks, odds, live stream, lineup prediction: Where to watch Euro 2024 online, TV channel

-

News3 weeks ago

News3 weeks agoKeKe Jabbar, star of Love & Marriage: Huntsville, dead at 42

-

News4 weeks ago

News4 weeks agoUFC 303: Alex Pereira rocks Jiří Procházka with head-kick KO to defend light heavyweight belt

-

News4 weeks ago

News4 weeks agoExclusive: Google says it cracked down on Chrystia Freeland deepfakes

-

News4 weeks ago

News4 weeks agoCanada Day: What’s open and closed on P.E.I.

-

News4 weeks ago

News4 weeks agoChristian McCaffrey Marries Olivia Culpo in Rhode Island Wedding