News

Nvidia stock slips even after earnings top Wall Street estimates and demand for AI chips surges

LOS ANGELES (AP) — Nvidia could have exceeded Wall Road estimates as its revenue jumped — buffeted by the chipmaking dominance that has cemented Nvidia’s place because the poster youngster of the substitute intelligence increase — however traders appeared lower than impressed.

The corporate reported a web revenue of to $16.6 billion. Adjusted for one-time objects, web revenue was $16.95 billion. Income rose to $30 billion, up 122% from a yr in the past and 15% from the earlier quarter.

By comparability, S&P 500 corporations total are anticipated to ship simply 5% development in income for the quarter, in line with FactSet. Nonetheless, Nvidia shares slipped practically 4% in after-hours buying and selling.

Ryan Detrick, chief market strategist at Carson Group, mentioned that regardless of rising income “it seems the bar was simply set a tad too excessive this earnings season.”

“Loss of life, taxes, and NVDA beats on earnings are three issues you possibly can financial institution on,” Detrick mentioned. “Right here’s the difficulty. The dimensions of the beat this time was a lot smaller than we’ve been seeing. Even future steering was raised, however once more not by the tune from earlier quarters.”

The corporate reported second-quarter adjusted earnings per share of 68 cents per share, up from 27 cents a yr in the past. Nvidia mentioned it expects third quarter income to develop to $32.5 billion, plus or minus 2%.

Nvidia has led the substitute intelligence sector to change into one of many inventory market’s greatest corporations, as tech giants proceed to spend closely on the corporate’s chips and information facilities wanted to coach and function their AI methods.

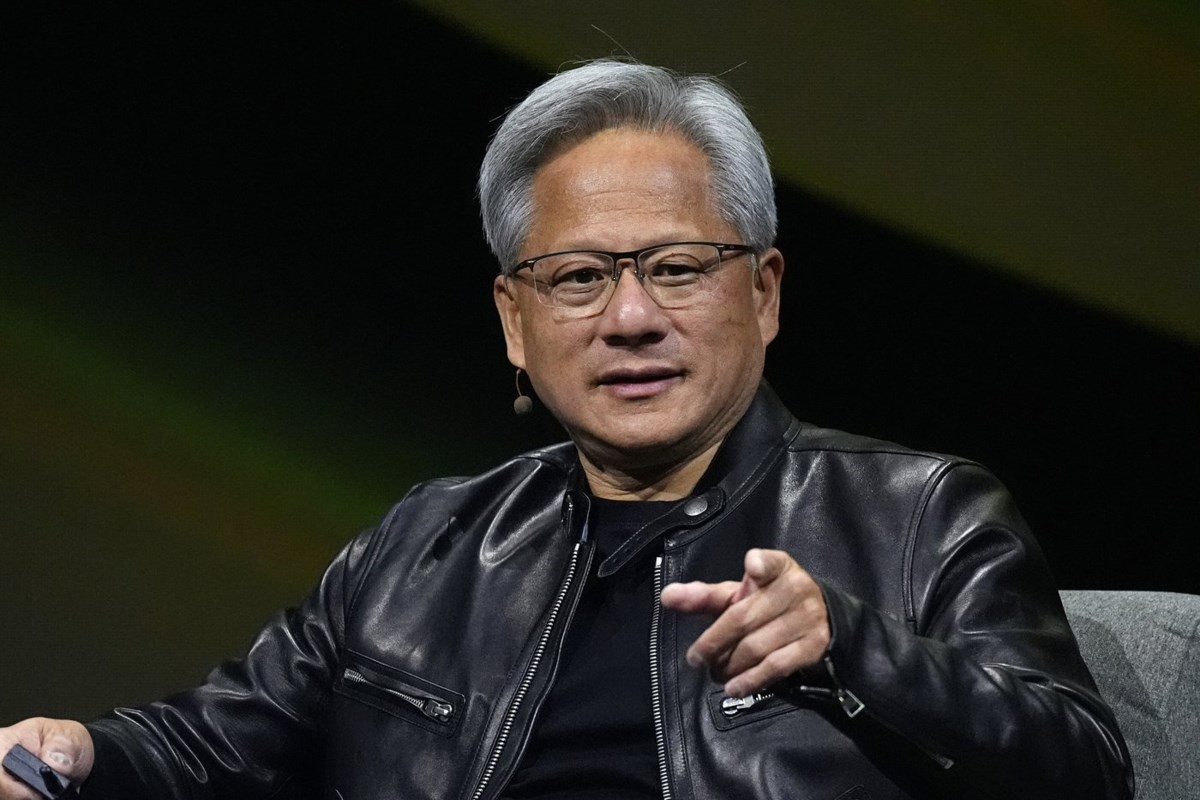

“The people who find themselves investing in Nvidia infrastructure are getting returns on it straight away,” Jensen Huang, founder and CEO of Nvidia, mentioned on a name with analysts. “It’s one of the best ROI infrastructure, computing infrastructure funding you can also make at the moment.”

Demand for generative AI merchandise that may compose paperwork, make photos and function private assistants has fueled gross sales of Nvidia’s specialised chips during the last yr. In June, Nvidia briefly rose to change into essentially the most worthwhile firm within the S&P 500. The corporate is now price over $3 trillion.

Nvidia CFO Colette Kress mentioned through the analyst name that the corporate is planning to extend manufacturing of its Blackwell AI chips starting within the fourth quarter and persevering with via fiscal 2026. Kress mentioned Nvidia expects a number of billion {dollars} in Blackwell income within the fourth quarter, with shipments of its Hopper graphics processor unit, or GPU, anticipated to extend within the second half of fiscal 2025.

In an interview with Bloomberg Tv, Huang mentioned the corporate will “have an incredible subsequent yr as properly.”

By means of the yr’s first six months, Nvidia’s inventory worth soared practically 150%. At that time, it was buying and selling at a bit greater than 100 occasions the corporate’s earnings over the prior 12 months. That’s way more costly than it’s been traditionally and than the S&P 500 usually. That is why analysts warn of a selloff if Wall Road sees any indication that AI demand is waning.

Dan Ives, an analyst with Wedbush Securities, referred to as the earnings a part of a “historic, meteoric rise from Nvidia and the godfather of AI, Jensen (Huang).” Traders, Ives added, are selecting aside “strong numbers” and looking for holes in them. Though Nvidia mentioned it estimates about $32.5 billion in income within the third fiscal quarter, some analysts anticipated a barely increased determine, he mentioned.

“I view it as sort of like splitting hairs,” Ives mentioned. The demand for AI know-how is simply accelerating, he added, echoing Huang’s earlier statements that the world is within the midst of the following industrial revolution.

“That is essentially the most watched earnings — not simply in tech, however out there, in a few years,” he mentioned. “Traders will initially overreact to any type of short-lived weak spot. However I consider this truly put extra gas into the tank of the bull market.”

Sarah Parvini, The Related Press

-

News4 weeks ago

News4 weeks agoMichael Vick says he will be the new head football coach at Norfolk State : NPR

-

News4 weeks ago

News4 weeks agoMufasa: The Lion King – six key things to know before watching the prequel | Ents & Arts News

-

News4 weeks ago

News4 weeks agoMichael Vick to become Norfolk State’s head football coach

-

News3 weeks ago

News3 weeks agoHow ‘A Complete Unknown’ Brings Bob Dylan’s 1960s New York Back to Life

-

News4 weeks ago

News4 weeks agoVancouver Canucks Recall Linus Karlsson And Phil Di Giuseppe, Send Mark Friedman And Arturs Silovs To Abbotsford

-

News4 weeks ago

News4 weeks agoToday is the winter solstice and 2024’s shortest day. Here’s what to know about the official start of winter.

-

News3 weeks ago

News3 weeks agoDenver chef brings new culinary twist to Mexican American pozole traditions

-

News3 weeks ago

News3 weeks agoWill Smith’s Superhero Dream Is Realized As He Becomes Wakanda’s Protector In MCU Concept Trailer