News

Intel (INTC) Q3 earnings report 2024

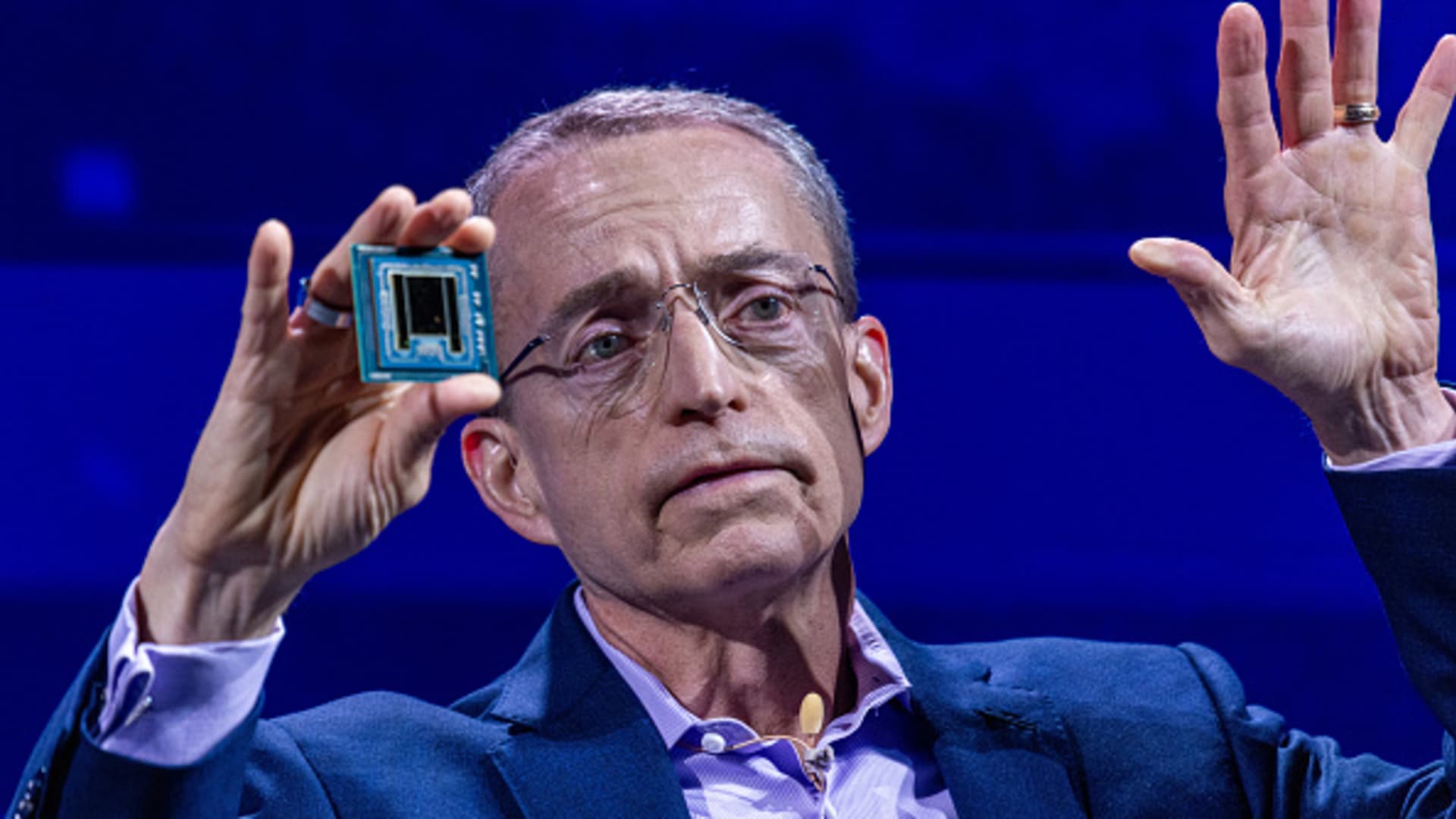

Intel CEO Pat Gelsinger holds a synthetic intelligence processor as he speaks through the Computex convention in Taipei, Taiwan, on June 4, 2024.

Annabelle Chih | Bloomberg | Getty Pictures

Intel shares rose 7% in prolonged buying and selling Thursday after the chipmaker reported better-than-expected earnings and issued quarterly steering that topped estimates.

Here is how the corporate did compared with LSEG consensus:

- Earnings per share: 17 cents adjusted vs. lack of 2 cents anticipated

- Income: $13.28 billion vs. $13.02 billion anticipated

Intel’s income declined 6% yr over yr within the fiscal third quarter, which ended Sept. 28, in accordance with a press release. The corporate registered a internet lack of $16.99 billion, or $3.88 per share, in contrast with internet earnings of $310 million, or 7 cents per share, in the identical quarter a yr in the past.

As a part of a value discount plan, Intel acknowledged $2.8 billion in restructuring expenses through the quarter. There was additionally $15.9 billion in impairment expenses tied partially to accelerated depreciation for Intel 7 course of node manufacturing belongings and goodwill impairment within the Mobileye unit.

The corporate is finishing up one of the vital seminal restructuring processes since its institution in 1968, CEO Pat Gelsinger stated on a convention name with analysts.

Intel stated in a submitting that on Oct. 28, the board’s audit and finance committee accepted value and capital discount actions, together with reducing head depend by 16,500 workers and decreasing its actual property footprint. The job cuts have been initially introduced in August. Restructuring ought to be carried out by the fourth quarter of 2025, Intel stated.

The corporate has been mired in an prolonged droop resulting from market share losses in its core companies and an lack of ability to crack synthetic intelligence. Intel revealed plans through the quarter to show the corporate’s foundry enterprise into an impartial subsidiary, a transfer that might allow exterior funding choices.

CNBC reported that Intel had engaged advisors to defend itself towards activist buyers. In late September, information surfaced that Qualcomm reached out to Intel a couple of attainable takeover.

The Consumer Computing Group that sells PC chips recorded $7.33 billion in fiscal third-quarter income, down about 7% from a yr earlier and under the $7.39 billion consensus amongst analysts surveyed by StreetAccount.

Clients drew down their inventories within the quarter after coping with provide shortages.

“We anticipate stock normalization will proceed via the primary half of subsequent yr,” Dave Zinsner, Intel’s finance chief, stated on the decision.

Income from the Information Heart and AI section got here to $3.35 billion, which was up about 9% and greater than the $3.17 billion consensus from StreetAccount.

Intel referred to as for fiscal fourth-quarter adjusted earnings of 12 cents per share and income between $13.3 billion and $14.3 billion. Analysts had anticipated 8 cents in adjusted earnings per share and $13.66 billion in income.

In the course of the quarter, Intel introduced the launch of Xeon 6 server processors and Gaudi AI accelerators. Uptake of Gaudi has been slower than Intel anticipated and the corporate won’t attain its $500 million income goal for 2024, Gelsinger stated on the decision.

As of Thursday’s shut, Intel shares have been down about 57% in 2024, whereas the S&P 500 had gained 20%.

WATCH: Qualcomm shopping for Intel can be a ‘horrible choice,’ says Harvest’s Paul Meeks

-

News4 weeks ago

News4 weeks agoDenver chef brings new culinary twist to Mexican American pozole traditions

-

News4 weeks ago

News4 weeks agoHow ‘A Complete Unknown’ Brings Bob Dylan’s 1960s New York Back to Life

-

News3 weeks ago

News3 weeks agoWill Smith’s Superhero Dream Is Realized As He Becomes Wakanda’s Protector In MCU Concept Trailer

-

News4 weeks ago

News4 weeks agoMerry Christmas from Answers in Genesis

-

News2 weeks ago

News2 weeks ago‘Home Improvement’ star out on bond after arrest in Myrtle Beach

-

News4 weeks ago

News4 weeks agoAs we celebrate Christmas, set a place at the festive table for memories • Kansas Reflector

-

News4 weeks ago

News4 weeks agoTrump threatens to try and regain control of Panama Canal

-

News3 weeks ago

News3 weeks agoCanucks’ Thatcher Demko leaves game vs. Kraken with back spasms