News

Canadian Dollar under pressure as US tariffs drive USD/CAD to a 22-year high

The USD/CAD pair surged above 1.4760 on Monday, reaching its highest degree since April 2003. This sharp rise got here in response to the US authorities’s choice to impose 25% tariffs on Canadian imports, considerably impacting the Loonie.

Key components driving USD/CAD

The White Home framed the tariffs as a part of a broader coverage to fight unlawful immigration and illicit commerce. Nonetheless, the financial repercussions are quick, notably for Canada’s commodity-driven economic system.

A separate 10% tariff has been utilized to Canadian power exports, a considerably decrease fee than initially anticipated. Comparable tariffs had been additionally launched for Mexico, whereas Chinese language items now face a ten% import responsibility. In response, all affected nations have signalled plans for retaliatory measures.

For Canada, the brand new commerce obstacles pose a big risk. With the economic system closely reliant on exports, lowered international demand may decrease international forex inflows and additional weaken the CAD.

Traders are actually turning their consideration to imminent Canadian GDP information. December’s figures are anticipated to indicate 0.2% development, translating to an annual enlargement of 1.4%, aligning with the Financial institution of Canada’s (BoC) projections.

The BoC lately reduce its benchmark rate of interest by 25 foundation factors to three.0% every year and introduced an finish to its quantitative easing programme. Moreover, the central financial institution has indicated plans to renew asset purchases in March, additional weighing on the Canadian greenback.

USD/CAD technical evaluation

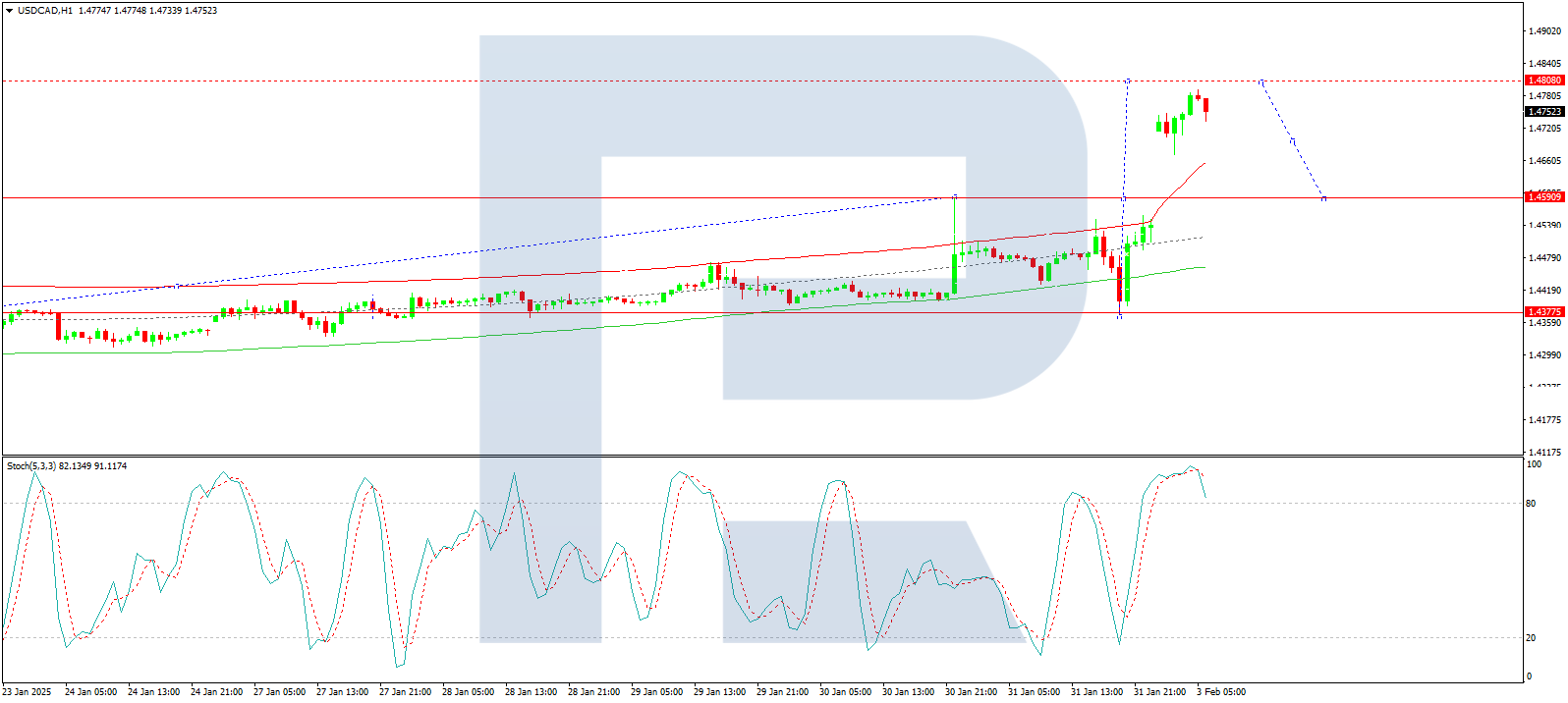

On the H4 chart, USD/CAD broke by 1.4591 and continues its upward wave. With this breakout, the trail in the direction of 1.4808 is now open, making it the following native goal. After reaching this degree, a correction in the direction of 1.4591 is feasible earlier than a renewed development wave targets 1.4919. The MACD indicator helps this outlook, with its sign line above zero and pointing sharply upwards, confirming bullish momentum.

On the H1 chart, the pair has prolonged its upward construction to 1.4742 and is now consolidating round this degree. A breakout from the consolidation vary to the upside would sign a transfer in the direction of 1.4808. Nonetheless, if the pair breaks downwards, a correction to 1.4591 is feasible earlier than one other try on the 1.4808 degree. The Stochastic oscillator signifies a possible short-term pullback, with its sign line above 80 and getting ready to say no in the direction of 20.

Conclusion

The Canadian greenback stays underneath important stress as US commerce tariffs drive uncertainty over future export demand. Whereas technical indicators recommend additional upside for USD/CAD in the direction of 1.4808, a corrective transfer in the direction of 1.4591 can also be potential earlier than one other wave of development. The market’s subsequent key focus will probably be Canadian GDP information and any additional developments on commerce retaliation from affected nations, each of which may impression the pair’s trajectory.

-

News4 weeks ago

News4 weeks agoHere’s the 2025 Houston Rodeo lineup – Houston Public Media

-

News4 weeks ago

News4 weeks agoTrump takes office – NBC New York

-

News4 weeks ago

News4 weeks agoCanadian school boards among those affected by cyber incident involving third party

-

News4 weeks ago

News4 weeks agoVikings Open Big Sky Home Schedule Thursday Against Eastern Washington

-

News4 weeks ago

News4 weeks agoZendaya, Should We Be Reading Into That Diamond on Your Ring Finger at the Golden Globes?

-

News4 weeks ago

News4 weeks agoLos Angeles Mayor Karen Bass under fire for response to raging wildfires

-

News4 weeks ago

News4 weeks agoBison Win 10th FCS National Championship 35-32 Over Montana State

-

News3 weeks ago

News3 weeks agoPatrik Laine earns Molson Cup honor for December