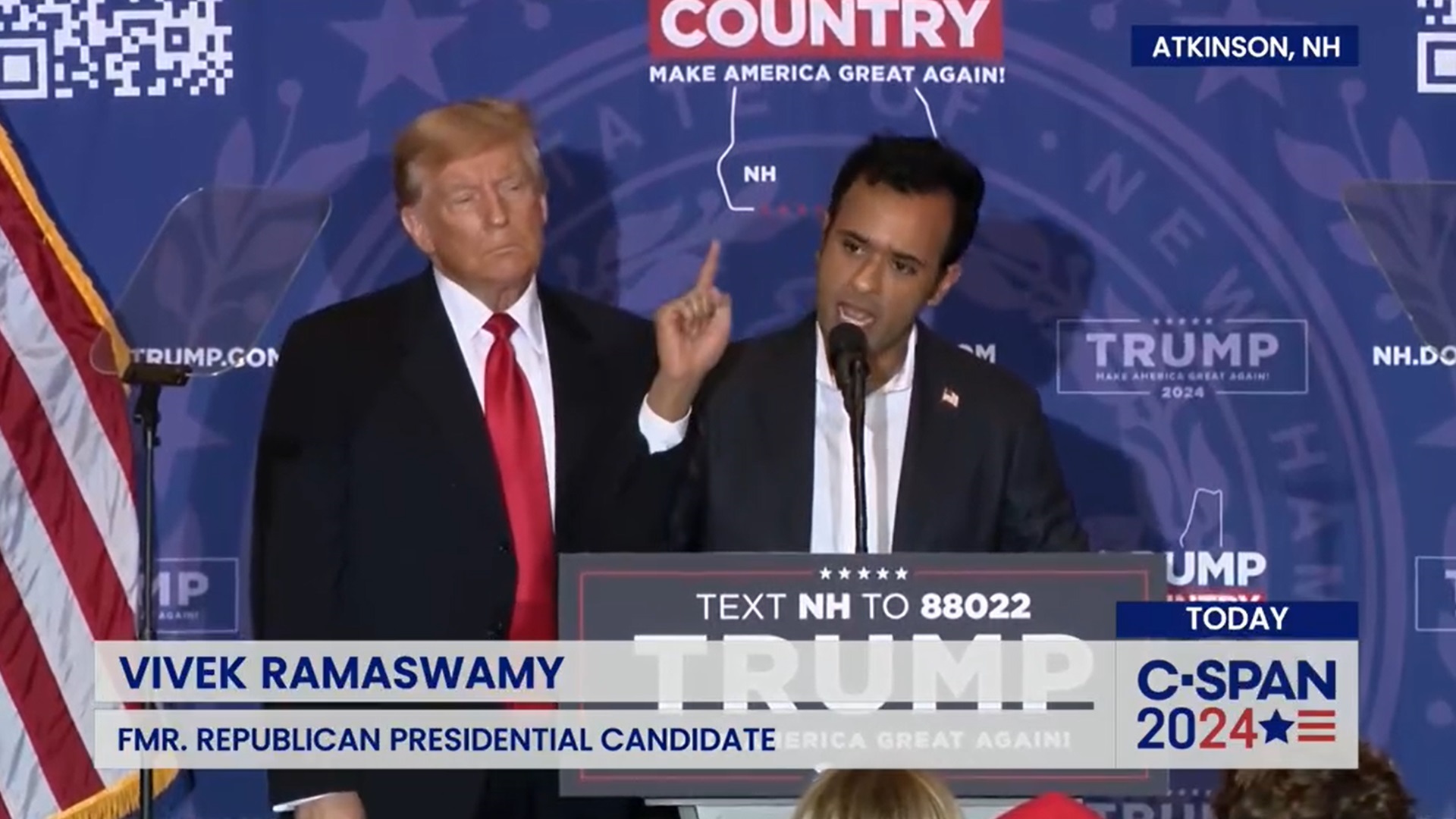

Vivek Ramaswamy is the billionaire Republican politician and failed presidential candidate whom Donald Trump appointed to guide the so-called “Division of Authorities Effectivity” (DOGE), alongside co-chair Elon Musk, the richest oligarch on Earth (who manufacturers himself a libertarian anti-government crusader, whereas his firms obtain billions in US authorities subsidies).

Ramaswamy sparked one thing of a civil conflict amongst US conservatives with a puerile Twitter submit lamenting how US standard tradition upholds jocks over nerds.

Method an excessive amount of digital ink has been spilled over this petty rant, however I needed to throw in my two cents and make a degree I haven’t seen emphasised sufficient: Though he likes to bloviate about engineers and scientists, Ramaswamy is in actuality a Wall Avenue finance bro!

He did briefly research biology as an undergraduate pupil at Harvard, however he labored for hedge funds and Goldman Sachs, and went to Yale Legislation College with JD Vance (one other pseudo-“populist” who obtained wealthy working for billionaire-backed enterprise capital funds).

Vivek Ramaswamy is not an engineer or a scientist.

Whereas he criticizes superficial US tradition, Ramaswamy is the embodiment of the superficial Wall Avenue speculators who make billions, but produce nothing for society; they only transfer capital round.

When Ramaswamy based his so-called “biotechnology” firm Roivant “Sciences”, he didn’t actually develop biotech. It began as a monetary agency. Forbes described it as an “funding holding firm”.

Ramaswamy’s technique was to purchase patents from different pharmaceutical firms that truly developed medication, to deliver these medication that actual scientists created to the market, and to get wealthy off of capital positive factors, not innovation.

Though he did certainly make some huge cash doing this, Ramaswamy was not very profitable at marketizing medication that really helped folks. As Forbes reported:

[Ramaswamy’s] thesis: Pharma giants had loads of deserted medication that may very well be value a fortune if somebody centered on them. One 12 months after founding the corporate [Roivant Sciences], certainly one of Roivant’s spinoffs, named Axovant, went public at a $2.2 billion valuation. Its prized asset: a much-hyped Alzheimer’s drug candidate, Intepirdine, which Ramaswamy had bought for simply $5 million. The 12 months that Axovant joined the New York Inventory Trade, Ramaswamy reported greater than $38 million of earnings, most of it from capital positive factors, on his tax return.

Intepirdine turned out to be a disappointment, failing a medical trial two years later.

This is the reason Jeffrey Sonnenfeld — virtually a determine of royalty within the US company world, who based Yale’s Chief Government Management Institute and has suggested a Who’s Who of highly effective CEOs — described Ramaswamy as an “entrepreneurial huckster” with a “shady enterprise monitor file of brazen pump-and-dump schemes”.

Given his impeccable company bona fides, Sonnenfeld’s exposé on Ramaswamy is devastating, and ought to be learn in full. However that is essentially the most related passage:

Ramaswamy’s tax data present that the primary time he ever made massive cash was when he overvalued an Alzheimer’s drug candidate, Axovant, which had been discarded by different pharmaceutical firms. Axovant, which was 78% owned by Ramaswamy’s company holding firm Roivant, blew up after failing FDA assessments, with the inventory crashing from $200 to 40 cents, fleecing hundreds of mom-and-pop buyers who purchased into the hype. Ramaswamy himself profited handsomely (even when the Ramaswamy marketing campaign took some time to acknowledge the reality).

Ramaswamy spokesperson Tricia McLaughlin first informed us that “the concept Vivek made any cash on [Axovant’s] failure is a complete lie” earlier than lastly acknowledging that Ramaswamy did certainly money out, claiming “[Ramaswamy] and different shareholders have been compelled to promote a tiny portion of their shares in 2015 to facilitate an out of doors investor getting into Roivant.” The info are that Ramaswamy’s personal tax returns present he opportunely bought out of almost $40 million of Roivant inventory proper as Axovant’s hype was peaking. In the meantime, Roivant was elevating $500 million pushed largely by Axovant. As Ramaswamy was busy promoting his personal private stake, Roivant step by step lowered and diluted its Axovant stake from 78% to only 25%.

Clearly, the info present Ramaswamy’s phrases didn’t match his actions as he was busy cashing out whereas shamelessly hyping Axovant’s prospects in media interviews–nearly resembling a basic pump-and-dump scheme. Some $40 million in private windfalls is hardly “tiny.” Ramaswamy was not “compelled to promote” as that was clearly a private alternative with out anybody holding a gun to his head. Amazingly, Ramaswamy’s spokesperson additional confirmed to us that Ramaswamy was conscious that 99.7% of all medication examined for Alzheimer’s fail although he was relentlessly hyping Axovant’s possibilities of success with nary a point out of that inconvenient fact.

Hilariously, Ramaswamy additionally acquired a fellowship from billionaire oligarch George Soros, the bugbear of the US proper, and paid a Wikipedia editor to attempt to excise this info from his web page on the net encyclopedia.

In the identical vein, Sonnenfeld famous that Ramaswamy is an “opportunistic, twin Ivy-Leaguer with well-educated skilled mother and father [who] was so determined to be recast as a populist that he sued the Davos World Financial Discussion board to purge him from the participant lists”.

The very fact is that, whereas he typically misleadingly presents himself as a “scientist”, Vivek Ramaswamy is simply one other parasitic Wall Avenue speculator — albeit a bit higher at PR than his erstwhile enterprise companion and buddy Martin Shkreli (the notorious “pharma bro” who made financial institution by value gouging on life-saving medication).

It is usually deeply ironic that Ramaswamy feigns concern in regards to the unhappy state of scientific schooling in the USA whereas he actively requires abolishing the Division of Training. Who’s going to teach the long run generations of engineers and scientists? If the DOGE of Ramaswamy and Musk will get its method, solely the elite youngsters of wealthy mother and father will be capable to afford high-quality schooling, at costly personal faculties within the US. (I assume everybody else may research overseas, the place overseas governments truly prioritize funding high-quality public schooling — slightly than plowing trillions of {dollars} into waging nonstop wars and sustaining a world empire with almost 800 overseas navy bases.)

Whereas Ramaswamy at all times prefers to distract from US social ills by fueling extra tradition conflict (or scapegoating China), the precise drawback in US society is that the neatest individuals are closely financially incentivized to go to regulation faculty; work at hedge funds, funding banks, and personal fairness corporations; and turn out to be Wall Avenue speculators, as an alternative of scientists and engineers. Numerous PhDs in physics, engineering, and arithmetic abandon their analysis to do glorified playing as quants.

Their job is to make wealthy oligarchs even richer, to not innovate and make common folks’s lives higher.

Vivek Ramaswamy ought to know; that’s his life story.