Individuals’s ‘magic quantity’ for retirement rises quicker than inflation, leaping 15% in only a yr and a whopping 53% since 2020; whereas retirement financial savings falls to $88K

The ‘Silver Tsunami’ is right here: 11,000 People will flip 65 each day via 2027; solely half of Boomers+ and Gen X imagine they will be financially prepared for retirement

Many years of Distinction: Gen Z began saving at 22 and expects to retire at 60; Boomers+ began saving at 37 and count on to retire at 72

Potential for Tax Planning: As tax season continues, simply 3 in 10 People imagine they’ve a tax-efficient retirement plan, presumably inflicting many to pay greater than required

MILWAUKEE, April 2, 2024 /PRNewswire/ — People’ “magic quantity” for retirement is surging to an all-time excessive – rising a lot quicker than the speed of inflation whereas swelling greater than 50% for the reason that onset of the pandemic. These are the most recent top-level findings from Northwestern Mutual’s 2024 Planning & Progress Examine, the corporate’s proprietary analysis sequence that explores People’ attitudes, behaviors and views throughout a broad set of points impacting their long-term monetary safety.

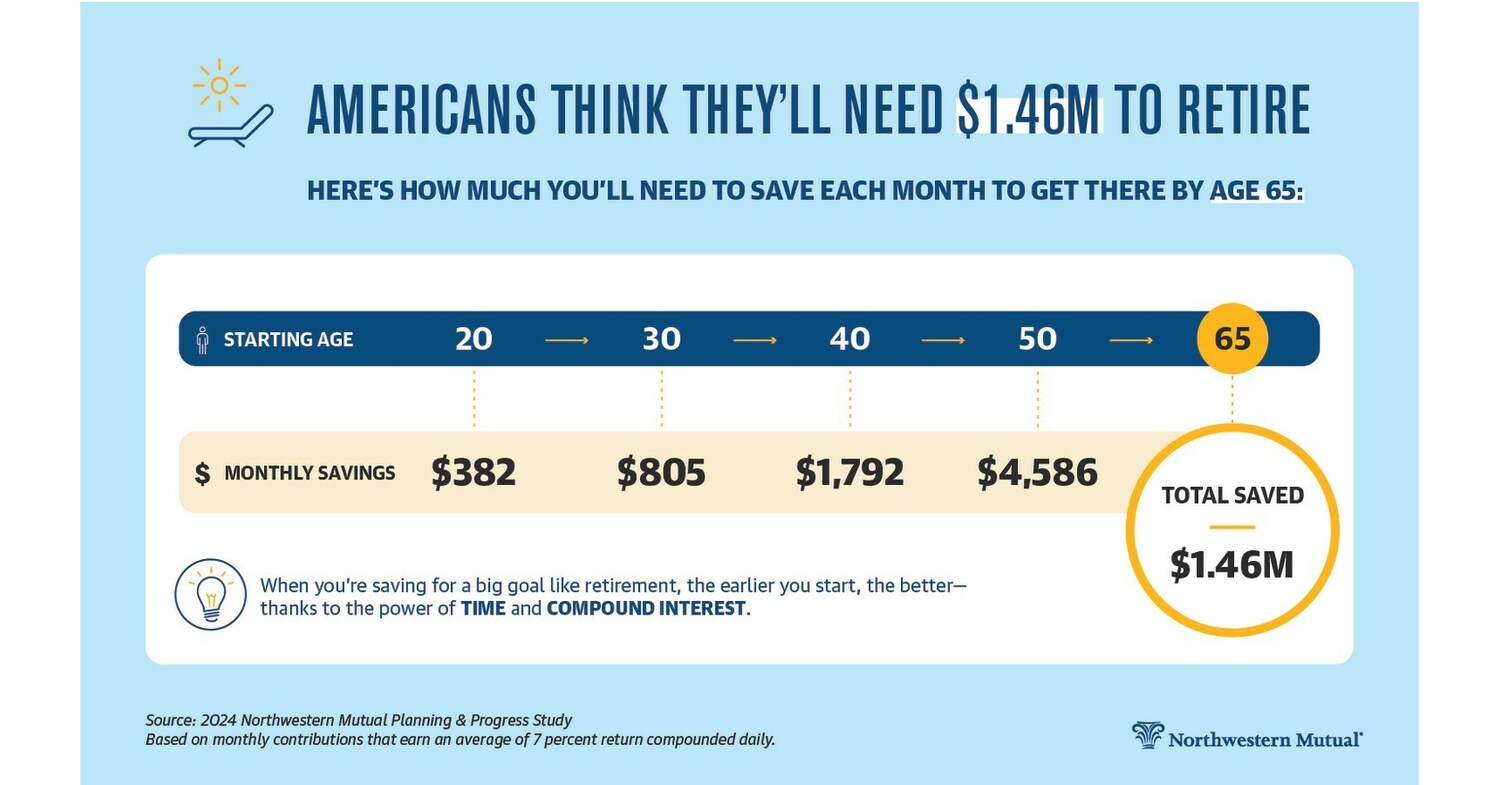

U.S. adults imagine they’ll want $1.46 million to retire comfortably, a 15% improve over the $1.27 million reported final yr, far outpacing right now’s inflation charge which presently hovers between 2% and three%. Over a five-year span, folks’s ‘magic quantity’ has jumped a whopping 53% from the $951,000 goal People reported in 2020.

|

2024 |

2023 |

2022 |

2021 |

2020 |

|

|

Quantity anticipated to |

$1.46M |

$1.27M |

$1.25M |

$1.05M |

$951K |

By technology, each Gen Z and Millennials count on to want greater than $1.6 million to retire comfortably. Excessive-net-worth people – folks with greater than $1 million in investable belongings – say they will want almost $4 million.

|

2024 |

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

HNW ($1M+) |

|

Quantity anticipated to |

$1.46M |

$1.63M |

$1.65M |

$1.56M |

$990K |

$3.93M |

In the meantime, the common quantity that U.S. adults have saved for retirement dropped modestly from $89,300 in 2023 to $88,400 right now, however is greater than $10,000 off its five-year peak of $98,800 in 2021.

|

2024 |

2023 |

2022 |

2021 |

2020 |

|

|

Quantity saved for retirement presently |

$88,400 |

$89,300 |

$86,900 |

$98,800 |

$87,500 |

|

Hole between retirement aim and present financial savings |

$1.37M |

$1.18M |

$1.16M |

$951K |

$864K |

“In 2023, the hovering value of eggs within the grocery retailer symbolized inflation in America. In 2024, it is nest eggs,” mentioned Aditi Javeri Gokhale, chief technique officer, president of retail investments and head of institutional investments at Northwestern Mutual. “Individuals’s ‘magic quantity’ to retire comfortably has exploded to an all-time excessive, and the hole between their targets and progress has by no means been wider. Inflation is increasing our expectations for retirement financial savings, and placing the strain on to plan and keep disciplined. Making a ‘magic quantity’ seem is not about waving a wand; it is about utilizing time-tested methods and studying from a talented advisor.”

Throughout all segments, there are massive gaps between what folks suppose they will have to retire and what they’ve saved to this point.

|

All |

Gen Z |

Millennials |

Gen X |

Boomers+ |

HNW ($1M+) |

|

|

Quantity saved for retirement presently |

$88,400 |

$22,800 |

$62,600 |

$108,600 |

$120,300 |

$172,100 |

|

Hole between retirement aim and present financial savings |

$1.37M |

$1.61M |

$1.59M |

$1.45M |

$870K |

$3.76M |

Gen Z: Beginning sooner with the goal of ending earlier

The examine finds the common age that People say they began saving for retirement is 31. However for Gen Z, it is 22 – almost a decade earlier. It is also a full 15 years earlier than Boomers+ who say they began once they had been 37. Millennials and Gen X’ers started saving for retirement at ages 27 and 31, respectively.

The hope amongst Gen Z is that by beginning to save sooner, they will be capable to retire earlier. They count on to retire on the age of 60, a dozen years earlier than Boomers+ who say they will work till they’re 72. Millennials and Gen X’ers count on to work till 64 and 67, respectively. The common age most individuals count on to work to is 65.

The analysis found that three in 10 Millennials and Gen Z People imagine it is doubtless or extremely doubtless that they’ll stay to age 100. The sentiment amongst these youthful generations is stronger than older generations. Amongst Gen X and Boomers+, simply 22% and 21% respectively agreed that they believed they might stay to 100.

“These numbers inform an enchanting story concerning the profound shift in monetary planning that has taken form in America,” mentioned Javeri Gokhale. “Younger folks right now acknowledge the worth of retirement planning and constructing wealth early on in life and are getting a big head begin over their dad and mom and grandparents. On the identical time, Gen Z is redefining retirement and signaling that they plan to have lengthy and fulfilling post-career lives. The excellent news is that they’re investing earlier to allow them to save the cash they should get pleasure from it.”

The ‘Silver Tsunami’ is right here

In 2024, greater than 4 million People will flip 65. That is a mean of 11,000 People per day, and it’ll proceed via 2027. It is the biggest surge of People hitting the standard retirement age in historical past.

The 2024 Planning & Progress Examine discovered that amongst generations closest to retirement, simply half of Boomers+ (49%) and Gen X (48%) imagine they are going to be financially ready when the time comes.

On common, Gen X believes there’s a 42% likelihood they might outlive their financial savings, whereas Boomers+ put the chance at 37%. Throughout each generations, greater than a 3rd (37% and 38%, respectively) haven’t taken any steps to deal with the potential of outliving their financial savings.

“The ‘Silver Tsunami’ is right here,” mentioned Javeri Gokhale. “Whereas youthful generations are centered on constructing wealth and defending what they’ve already constructed, Gen X and Boomers have a further essential job: paying themselves first in retirement. The place they’ve financial savings may be simply as essential as how a lot they’ve saved. Carried out properly, a complete monetary plan can protect hundreds of hard-earned {dollars} to fund these golden years. For anybody who will not be certain how you can streamline and protect each penny, an knowledgeable monetary advisor is usually a nice useful resource.”

When digging into a few of the most urgent challenges related to retirement planning, the analysis reveals that Boomers+ and Gen X haven’t got markedly robust confidence of their preparedness.

|

Boomers+ |

Gen X |

|

|

I understand how a lot cash I might want to retire comfortably |

49 % |

40 % |

|

I’ve a plan to deal with healthcare prices in retirement |

56 % |

44 % |

|

I’ve deliberate for the chance that I may outlive my financial savings |

37 % |

35 % |

|

I’ve a plan to deal with long-term care wants in retirement |

41 % |

34 % |

|

I’ve deliberate for the potential that Social Safety could or could not |

39 % |

42 % |

|

I’ll have sufficient to depart behind an inheritance or reward to liked |

50 % |

36 % |

|

I’ve an excellent understanding of how taxes may impression my |

58 % |

46 % |

|

I’ve an excellent understanding of how potential drops within the inventory |

58 % |

51 % |

Taxes are an afterthought

Solely three in 10 (30%) People have a plan to reduce the taxes they pay on their retirement financial savings. Amongst them, the highest 10 methods employed embody:

- Making withdrawals strategically from conventional and Roth accounts to stay in a decrease tax bracket (32%)

- Utilizing a mixture of conventional and Roth retirement accounts (30%)

- Making strategic charitable donations (24%)

- Utilizing a Well being Financial savings Account (HSA) or different tax-advantaged healthcare account (23%)

- Utilizing merchandise like everlasting life insurance coverage or annuities for the tax advantages (22%)

- Making Roth conversions previous to taking RMDs or Social Safety (19%)

- Utilizing certified charitable distributions from an IRA (17%)

- Making contributions to different tax-advantaged accounts like a 529 (14%)

- Utilizing the idea paid into the money worth of everlasting life insurance coverage to stay in a decrease tax bracket (13%)

- Profiting from a Certified Longevity Annuity Contract (QLAC) to put aside funds for later in retirement (13%)

“Placing cash right into a 401K might not be sufficient to retire comfortably if the monetary plan does not tackle the impression of taxes on retirement revenue,” mentioned Javeri Gokhale. “Most individuals do not realize that their retirement revenue could also be taxed about 20% or 30% once they withdraw and spend it. Once they acknowledge the impression, it is usually too late for them to regulate. A complete monetary plan will help folks get to and thru retirement by minimizing publicity and stopping anybody from paying extra in taxes than they need to be – probably preserving hundreds of {dollars} of their nest eggs.”

In forthcoming knowledge units, the 2024 Planning & Progress Examine will discover wide-ranging points dealing with People spanning financial savings and debt, retirement revenue, rising know-how, skilled assist and extra.

About The 2024 Northwestern Mutual Planning & Progress Examine

The 2024 Planning & Progress Examine was carried out by The Harris Ballot on behalf of Northwestern Mutual amongst 4,588 U.S. adults aged 18 or older. The survey was carried out on-line between January 3 and January 17, 2024. Knowledge are weighted the place obligatory by age, gender, race/ethnicity, area, training, marital standing, family measurement, and family revenue to deliver them in keeping with their precise proportions within the inhabitants. An entire survey methodology is accessible.

About Northwestern Mutual

Northwestern Mutual has been serving to folks and companies obtain monetary safety for greater than 165 years. By means of a complete planning method, Northwestern Mutual combines the experience of its monetary professionals with a customized digital expertise and industry-leading merchandise to assist its shoppers plan for what’s most essential. With over $627 billion of whole belongings[i] being managed throughout the corporate’s institutional portfolio in addition to retail funding shopper portfolios, greater than $36 billion in revenues, and $2.3 trillion value of life insurance coverage safety in power, Northwestern Mutual delivers monetary safety to greater than 5 million folks with life, incapacity revenue and long-term care insurance coverage, annuities, and brokerage and advisory companies. Northwestern Mutual ranked 111 on the 2023 FORTUNE 500 and was acknowledged by FORTUNE® as one of many “World’s Most Admired” life insurance coverage firms in 2024.

Northwestern Mutual is the advertising title for The Northwestern Mutual Life Insurance coverage Firm (NM), Milwaukee, WI (life and incapacity insurance coverage, annuities, and life insurance coverage with long-term care advantages) and its subsidiaries. Subsidiaries embody Northwestern Mutual Funding Companies, LLC (NMIS) (funding brokerage companies), broker-dealer, registered funding adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Administration Firm® (NMWMC) (funding advisory and companies), federal financial savings financial institution; and Northwestern Lengthy Time period Care Insurance coverage Firm (NLTC) (long-term care insurance coverage). Not all Northwestern Mutual representatives are advisors. Solely these representatives with “Advisor” of their title or who in any other case disclose their standing as an advisor of NMWMC are credentialed as NMWMC representatives to supply funding advisory companies.

i Consists of investments and separate account belongings of Northwestern Mutual in addition to retail funding shopper belongings held or managed by Northwestern Mutual.

This materials will not be supposed as authorized or tax recommendation. Monetary Representatives don’t give authorized or tax recommendation. Taxpayers ought to seek advice from an unbiased tax or authorized advisor

SOURCE Northwestern Mutual