News

Salesforce’s stock suffers its biggest drop in two decades

By Emily Bary

Salesforce shares sink as the corporate has buyers rethinking its development outlook

Traders looking for extra causes to be cautious concerning the well being of the software program sector simply obtained an enormous one, as Salesforce Inc. lower its subscription-revenue outlook and mentioned heavy scrutiny on spending on the a part of its clients.

The places and takes from Wednesday afternoon’s earnings report resulted in a decline that Salesforce shares (CRM) hadn’t seen in years. The inventory fell 19.7% on Thursday, representing Salesforce’s largest single-day proportion drop because the inventory fell 27.2% on July 21, 2004. It was additionally the most important one-day level drag – down 353.30 factors – for a single inventory within the Dow Jones Industrial Common in 20 years, based on Dow Jones Market Knowledge.

Commentary from Salesforce and different software program gamers is weighing closely on the general sector Thursday, with the iShares Expanded Tech-Software program Sector exchange-traded fund IGM off 2.5%. Shares of ServiceNow Inc. (NOW) and Adobe Inc. (ADBE) have been different notable losers.

See extra: Salesforce’s inventory tumbles as earnings present newest dose of software-sector ache

“We’ve got mentioned for a while that we stay skeptical concerning the elementary drivers of the enterprise going ahead, together with each their core initiatives and their potential to monetize the AI alternative, which the road appeared bullish on,” Bernstein analyst Mark Moerdler wrote as he stored an underperform ranking on the inventory, whereas boosting his value goal to $234 from $231.

“After this quarter’s outcomes, with the inventory down -16% within the aftermarket, we expect the weak spot within the enterprise is turning into more and more seen,” Moerdler added.

He mentioned that “buyers might want to reset how they give thought to the corporate” and its development prospects now that the potential for low- to mid-teens development on a proportion foundation now not appears viable.

Learn: UiPath’s inventory will get slammed upon CEO’s abrupt exit, huge miss on steering

Salesforce maintained its whole income outlook for the fiscal 12 months, which requires 8% to 9% development, though it lower its subscription-revenue outlook. Subscription and help income is now anticipated to come back in barely under 10% development, whereas Salesforce beforehand was in search of about 10% development.

The report “will possible weigh closely on software program sentiment and ensure fears that the general spending backdrop [year to date] has weakened,” added UBS analyst Karl Keirstead.

From his perspective, “the malaise is broad, not Salesforce-specific, and we do not see proof of a [second-half] restoration.”

There’s additionally “some (not materials) danger of one other trim, as Salesforce did not explicitly drag weak spot within the month April throughout the reminder of the fiscal 12 months,” Keirstead famous, as he maintained a impartial ranking on the shares however lower his value goal to $250 from $310.

Guggenheim’s John DiFucci took an identical view.

“We see danger in subscription income steering because it implies important uptick in new [annual contract value] development within the [second half of fiscal 2025],” he wrote.

His assumptions are for “extra affordable new ACV development for the remainder of the 12 months,” and that means roughly 8% development in subscription income. “This can possible lead to downward revision to whole income, until Salesforce is ready to offset it with Skilled Companies income, because it simply did,” DiFucci famous.

He has a impartial ranking on the inventory.

Evercore ISI’s Kirk Materne was extra optimistic. Salesforce “will get zero credit score for holding the [fiscal year] income information intact right this moment, however we consider the corporate stored it unchanged for a purpose – notably visibility into pipeline and favorable pricing tailwinds” within the second half, he wrote.

Do not miss: Okta lifts its earnings outlook whereas taking ‘prudent’ view of shoppers’ budgets

Materne mentioned there was “no technique to clarify away” softness within the newest quarter or to present buyers whole confidence that the brand new outlook is “de-risked,” however he mentioned Salesforce is in contrast to different software program performs in that it is “basically a margin growth/[free-cash-flow] development story at this level.”

He has an outperform stance and $300 goal value on Salesforce shares.

-Emily Bary

This content material was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is printed independently from Dow Jones Newswires and The Wall Avenue Journal.

(END) Dow Jones Newswires

05-30-24 1624ET

Copyright (c) 2024 Dow Jones & Firm, Inc.

-

News4 weeks ago

News4 weeks agoDavid Hasselhoff Mourns Baywatch Costar Michael Newman

-

News4 weeks ago

News4 weeks agoWinners And Losers From Topuria Vs. Holloway Card

-

News4 weeks ago

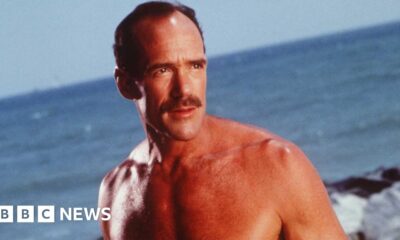

News4 weeks agoDr. Ron Stewart, pioneer of emergency and paramedicine, dies at 82 – Dal News

-

News4 weeks ago

News4 weeks agoDavid Hasselhoff leads tributes to Baywatch star

-

News4 weeks ago

News4 weeks agoBroncos receiver Josh Reynolds recovering from two gunshot wounds after visit to strip club

-

News3 weeks ago

News3 weeks ago‘Dragon Age: The Veilguard’ Review: A Well-Aged Dragon

-

![Here’s The Exact Time ‘Black Ops 6’ Launches On PC, Xbox And PS5 In Every Timezone [Update]](https://theepictimes.com/wp-content/uploads/2024/10/Heres-The-Exact-Time-‘Black-Ops-6-Launches-On-PC-400x240.jpg)

![Here’s The Exact Time ‘Black Ops 6’ Launches On PC, Xbox And PS5 In Every Timezone [Update]](https://theepictimes.com/wp-content/uploads/2024/10/Heres-The-Exact-Time-‘Black-Ops-6-Launches-On-PC-80x80.jpg) News4 weeks ago

News4 weeks agoHere’s The Exact Time ‘Black Ops 6’ Launches On PC, Xbox And PS5 In Every Timezone [Update]

-

News3 weeks ago

Dragon Age: The Veilguard (Xbox Series X) Review