News

Update: Bank of Canada cuts interest rate: What to know

Article content material

Eight occasions a yr the Financial institution of Canada makes one in every of three selections on in a single day rates of interest. It both stands pat, raises the speed or lowers it.

Article content material

The hyperlink between inflation and rates of interest

Managing rates of interest known as financial coverage and it’s a key method that the BoC manages the economic system. Rates of interest are used to regulate the speed of inflation, which is the proportion distinction between the worth of a bundle of products at one cut-off date in contrast with one yr prior.

The BoC likes the speed of inflation to be at round two per cent, so that there’s financial development, however prices aren’t rising quicker than earnings development for common Canadians.

If the speed of inflation is simply too excessive it signifies an economic system that’s rising too swiftly. The BoC’s logic is that a rise in rates of interest will decelerate the economic system, whereas lowering the speed of curiosity will stimulate the economic system.

What has been occurring over the previous few years

When COVID-19 arrived in Canada in spring 2020, the speed of inflation and the BoC in a single day rate of interest have been each round two per cent and had been that method for a number of years.

The very first thing that occurred with COVID was the value of a litre of gasoline went down. Actual property costs stalled as viewings have been cancelled after which the economic system slowed method down. This led to the BoC bringing its in a single day rate of interest right down to 0.25 per cent from 1.75 per cent in March 2020 with inflation hovering round zero.

Article content material

Nonetheless, because the pandemic wore on, the actual property market picked proper up and provide chain points led to a rise within the value of products.

This meant it was dearer to do enterprise and it was the beginning of a basic rise in inflation as prices have been handed on to shoppers.

By February 2022 inflation in Canada was 5.7 per cent and the BoC determined to behave, growing the in a single day rate of interest to 0.5 per cent.

Inflation continued to rise and peaked in Canada in June 2022 at 8.1 per cent, by which era the BoC had elevated the rate of interest to 2.5 per cent. As charges rose, inflation fell, however not quick sufficient and charges continued to rise, peaking at 5 per cent in July 2023 – the place it sat till June 2024 when it was lowered to 4.75 per cent, with inflation at 2.7 per cent.

In July the speed got here right down to 4.5 per cent, then 4.25 per cent in September and three.75 in October. The final time it was 3.75 per cent was in October 2022.

What occurred on Wednesday?

The BoC will drop the in a single day rate of interest by 0.5 per cent to three.25 per cent.

In response to the BMO Canada Financial Outlook launched final week, “since June, (BoC) has reduce charges by 1.25 per cent, and we count on one other reduce throughout their remaining rate of interest assembly in December, in addition to a sequence of cuts via mid-2025. All advised, we count on the in a single day rate of interest to fall from the present 3.75 per cent to 2.5 per cent by the center of 2025. If something, the Financial institution of Canada could also be much more aggressive.”

Information launched final Friday confirmed the jobless fee had climbed to six.8 per cent — the best since 2021. That led economists at Scotiabank and the Financial institution of Montreal to hitch Canada’s 4 different main lenders in predicting officers will drop the BoC’s in a single day lending fee half-a-per-cent to three.25 per cent.

With information from Bloomberg

Advisable from Editorial

-

Financial institution of Canada cuts its coverage fee by one other half level

-

Rates of interest for B.C. owners may very well be down to three.25% by finish of 2025

-

What B.C. mortgagors ought to find out about increased rate of interest renewals

Share this text in your social community

-

News4 weeks ago

News4 weeks agoWhat Did Matt Gaetz’s Wife Say About His Scandal?

-

News4 weeks ago

News4 weeks agoUFC Fight Night: Yan vs Figueiredo Main Card Results

-

News4 weeks ago

News4 weeks agoPutin says Russia attacked Ukraine with a new missile and threatens Western countries arming Ukraine

-

News4 weeks ago

News4 weeks agoWhy Russell Wilson and Sam Darnold look better, plus Caleb Williams hope

-

News4 weeks ago

News4 weeks ago‘We Can’t Go On Like This!’

-

News4 weeks ago

News4 weeks agoWhat next for Man City after stunning Spurs defeat?

-

News4 weeks ago

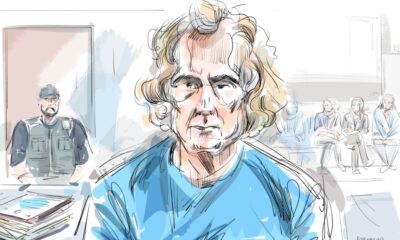

News4 weeks agoPaul Bernardo denied parole: Key moments from the hearing

-

News4 weeks ago

News4 weeks agoTexas Tech football wins a wild one at Oklahoma State