News

How US fraud charges against him impact India’s economy and politics

Getty Photographs

Getty PhotographsSimply weeks in the past, Gautam Adani, one of many world’s richest males, celebrated Donald Trump’s election victory and introduced plans to take a position $10bn (£7.9bn) in power and infrastructure tasks within the US.

Now, the 62-year-old Indian billionaire and an in depth ally of Prime Minister Narendra Modi, whose sprawling $169bn empire spans ports and renewable power, faces US fraud prices that would doubtlessly jeopardise his ambitions at residence and overseas.

Federal prosecutors have accused him of orchestrating a $250m bribery scheme and concealing it to boost cash within the US. They allege Mr Adani and his executives paid bribes to Indian officers to safe contracts value $2bn in earnings over 20 years. Adani Group has denied the allegations, calling them “baseless.”

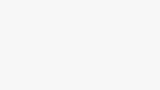

However that is already hurting the group and the Indian economic system.

Adani Group companies misplaced $34bn in market worth on Thursday, decreasing the mixed market capitalisation of its 10 firms to $147bn. Adani Inexperienced Power, which is the agency on the centre of the allegations, additionally mentioned it would not proceed with a $600m bond providing.

Then there are questions concerning the influence of the costs on India’s enterprise and politics.

Getty Photographs

Getty PhotographsIndia’s economic system is deeply intertwined with Mr Adani, the nation’s main infrastructure tycoon. He operates 13 ports (30% market share), seven airports (23% of passenger site visitors), and India’s second-largest cement enterprise (20% of the market).

With six coal-fired energy vegetation, Mr Adani is India’s largest non-public participant in energy. On the identical time, he has pledged to take a position $50bn in inexperienced hydrogen and runs a 8,000km (4,970 miles)-long pure fuel pipeline. He’s additionally constructing India’s longest expressway and redeveloping India’s largest slum. He employs over 45,000 folks, however his companies influence tens of millions nationwide.

His world ambitions span coal mines in Indonesia and Australia, and infrastructure tasks in Africa.

Mr Adani’s portfolio carefully mirrors Modi’s coverage priorities, starting with infrastructure and extra just lately increasing into clear power. He has thrived regardless of critics labeling his enterprise empire as crony capitalism, pointing to his shut ties with Modi, each as Gujarat’s chief minister – the place they each hail from – and as India’s prime minister. (Like several profitable businessman, Mr Adani has additionally solid ties with many opposition leaders, investing of their states.)

“This [the bribery allegations] is large. Mr Adani and Modi have been inseparable for a very long time. That is going to affect the political economic system of India,” says Paranjoy Guha Thakurta, an Indian journalist who has written extensively on the enterprise group.

AFP

AFPThis disaster additionally comes as Mr Adani has spent almost two years making an attempt to rebuild his picture after US short-seller Hindenburg Analysis’s 2023 report accused his conglomerate of many years of inventory manipulation and fraud. Although Mr Adani denied the claims, the allegations triggered a market sell-off and an ongoing investigation by India’s market regulator, SEBI.

“Mr Adani has been making an attempt to rehabilitate his picture, and attempt to present that these earlier fraud allegations leveled by the Hindenburg group weren’t true, and his firm and his companies had really been doing fairly properly. There’d been numerous new offers and investments made over the past yr or so, and so that is only a physique blow coming to this billionaire who had finished an excellent job of shaking off the potential injury of these earlier allegations,” Michael Kugelman of the Wilson Middle, an American think-tank, instructed the BBC.

For now, elevating capital at residence could show difficult for Mr Adani’s cash-guzzling tasks.

“The market response reveals how critical that is,” Ambareesh Baliga, an impartial market analyst, instructed the BBC. “Adanis will nonetheless safe funding for his or her main tasks, however with delays.”

AFP

AFPThe newest prices may additionally throw a spanner in Mr Adani’s world growth plans. He has been already challenged in Kenya and Bangladesh over a deliberate takeover of a global airport and a controversial power deal. “This [bribery charges] stops worldwide growth plans linked to the US,” Nirmalya Kumar, Lee Kong Chian Professor at Singapore Administration College, instructed the BBC.

What’s subsequent? Politically, opposition chief Rahul Gandhi has unsurprisingly referred to as for Mr Adani’s arrest and promised to fire up parliament. “Bribing authorities officers in India will not be information, however the quantities talked about are staggering. I think the US has names of a few of those that have been the meant recipients. This has potential reverberations for the Indian political scene. There’s extra to return,” Mr Kumar believes.

Mr Adani’s crew will undoubtedly assemble a top-tier authorized defence. “For now, now we have solely the indictment, leaving a lot nonetheless to unfold,” says Mr Kugelman.

AFP

AFPWhereas the US-India enterprise relationship could face scrutiny, it’s unlikely to be considerably impacted, significantly given the current $500m US take care of Mr Adani for a port venture in Sri Lanka, says Mr Kugelman. Regardless of the intense allegations, broader US-India enterprise ties stay robust.

“The US-India enterprise relationship is a really massive and multifaceted one. Even with these very critical allegations in opposition to somebody that is such a significant participant within the Indian economic system, I do not suppose we should always overstate the influence that this might have on that relationship,” Mr Kugelman says.

Additionally, it is unclear if Mr Adani may be focused, regardless of the US-India extradition treaty, because it relies on whether or not the brand new administration permits the instances to proceed. Mr Baliga believes it isn’t doom and gloom for the Adanis. “I nonetheless do suppose international traders and banks will again them like they did submit Hindenburg although, provided that they’re a part of crucial, properly performing sectors of the Indian economic system,” he says.

“The sense available in the market can be that this may maybe blow over and be sorted out, as soon as the [Donald] Trump administration takes over.”

-

News4 weeks ago

News4 weeks agoWinners And Losers From Topuria Vs. Holloway Card

-

News4 weeks ago

News4 weeks agoDr. Ron Stewart, pioneer of emergency and paramedicine, dies at 82 – Dal News

-

News4 weeks ago

News4 weeks agoBroncos receiver Josh Reynolds recovering from two gunshot wounds after visit to strip club

-

News3 weeks ago

News3 weeks ago‘Dragon Age: The Veilguard’ Review: A Well-Aged Dragon

-

News3 weeks ago

News3 weeks agoWhat Is Heidi Klum’s Halloween Costume In 2024? See The Big Reveal

-

![Here’s The Exact Time ‘Black Ops 6’ Launches On PC, Xbox And PS5 In Every Timezone [Update]](https://theepictimes.com/wp-content/uploads/2024/10/Heres-The-Exact-Time-‘Black-Ops-6-Launches-On-PC-400x240.jpg)

![Here’s The Exact Time ‘Black Ops 6’ Launches On PC, Xbox And PS5 In Every Timezone [Update]](https://theepictimes.com/wp-content/uploads/2024/10/Heres-The-Exact-Time-‘Black-Ops-6-Launches-On-PC-80x80.jpg) News4 weeks ago

News4 weeks agoHere’s The Exact Time ‘Black Ops 6’ Launches On PC, Xbox And PS5 In Every Timezone [Update]

-

News3 weeks ago

Dragon Age: The Veilguard (Xbox Series X) Review

-

News4 weeks ago

News4 weeks agoKlay Thompson sets 3s record for Dallas debut in Mavs win after 13 seasons with Warriors